Get the necessary foundation, strategy, and structure needed to

ensure that data is managed as an asset across the enterprise

Vision Data Governance provides all data management practices to

transform your data into meaningful information you can profit from

Get the necessary foundation, strategy, and structure needed to

ensure that data is managed as an asset across the enterprise

Vision Data Governance provides all data management practices to

transform your data into meaningful information you can profit from

Create consistent and high quality data to support all business objectives

Data governance encompasses the people, processes, and information technology required to create a consistent and proper handling of an organization’s data across the business enterprise. Vision Data Governance is a data management concept concerning the capability that enables an organization to ensure that high data quality exists throughout the complete lifecycle of the data, and data controls are implemented that support business objectives.

Regulatory authorities are focussing on what banking institutions are doing with their data. This is to ensure that in a rapidly changing technological environment, data is well-handled and not misused or at risk. Vision Data Governance provides the right data framework, data policies and data technologies that can enable data security, master data, and metadata and more to ensure true alignment.

B E N E F I T S

Strategic benefits

of business agility,

and customer intimacy.

Managerial benefits include complete management control and adherence to regulatory compliance.

Operational benefits like

optimisation of business

processes and reduction

in operational costs.

Organisational benefits

include higher employee

satisfaction, and alignment

to the organisation’s vision.

IT benefits such as

reduced IT maintenance

costs and fewer complex

processes.

Common data challenges for your bank

Homonym and multiple identifiers

Ineffective definition of identifiers across systems in the bank lead to increased overhead in terms of maintaining the relation and connectivity of the disparately defined identifiers. This can result into incorrect business decisions due to duplication of identifiers.

Incomplete or inaccurate customer onboarding

Inaccurate or incomplete capture of customer data leads to improper service to the customer which in turn churns the customer. In addition, non-systematic or manually intensive on-boarding process results in long lead times.

Multiple source systems or lack of golden source

Legacy systems with unreliable, unrepeatable

calculations combined with stale data, and breaks in data

flow and data lineage result in loss of a golden source of

data that is important for regulatory compliance.

Lack of ownership and inconsistent remediation

Too many layers of data could result in a lack of ownership thus resulting in delayed and inconsistent remediation. Furthermore, it increases operational inefficiency and leads to duplication of efforts.

Lack of business glossary and data dictionary

A lack of business glossary and data dictionaries impact the understanding and use of data concepts, inconsistent models, lineage, and definitions. This can lead to reactive measures such as reconciliations and exception management.

Lack of issue management and root cause identification

Lack of oversight and resolution management leads to use of temporary tactical solutions that neither identify nor fix the root causes of the issue.

Here’s why data Governance is important for your bank

Every day, data grows exponentially, and so do the stringent regulations and compliance defined by regulatory authorities. This growth of data combined with technological advances can present challenges for banks in how they read, use and govern data. It is important that banks do not lose control over data, one of their critical assets and instead gain meaningful insights from their data. Data governance services ensures that the right people are involved in determining the standards, usage and integration of data across projects, subject areas and lines of business in your bank.

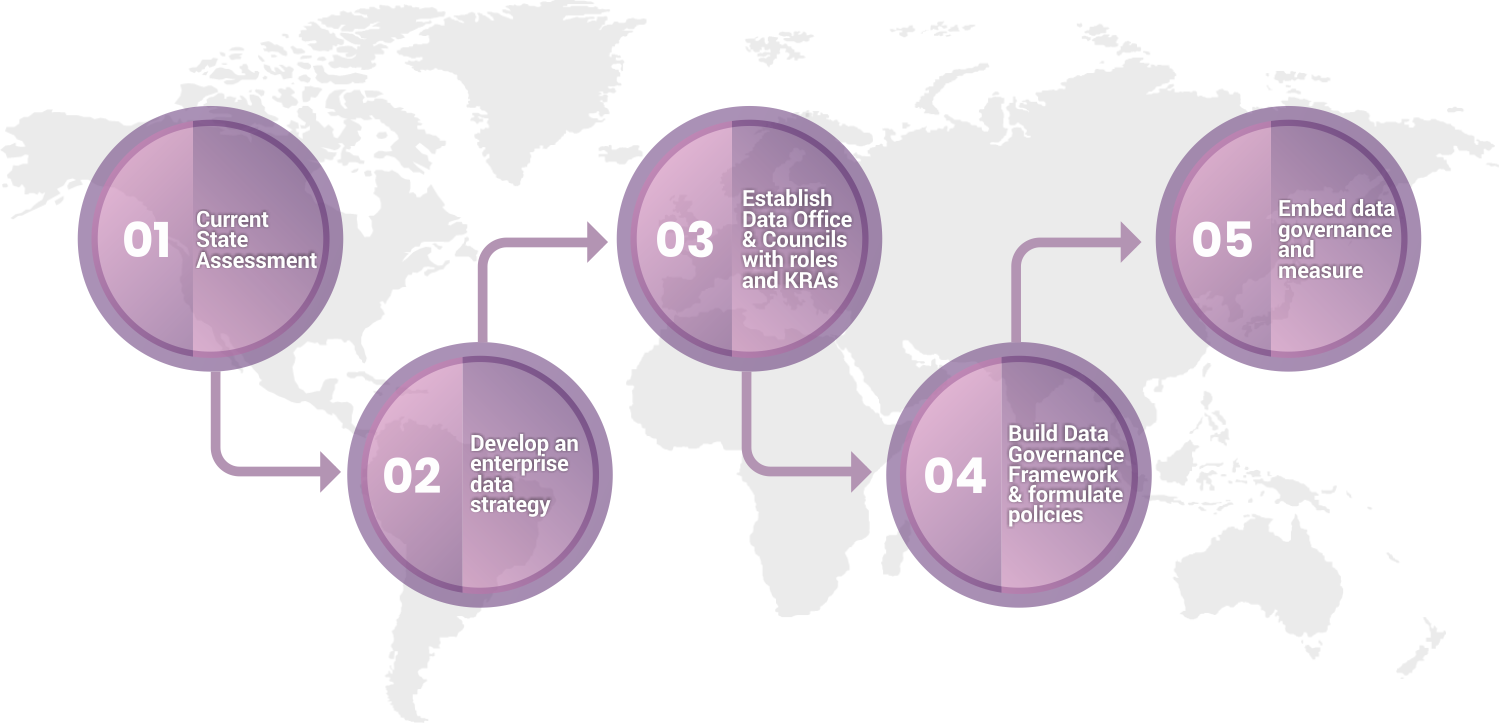

Sunoida's approach for Vision Data Governance Solution

Sharp service capabilities to mitigate your data challenges

Creates SMART Data

Vision Data Governance creates suitable data that fits your purpose;

well-managed data that is defined, governed and measured for quality;

easily accessible data; reliable data in the format you need; and timely data that is available when you need it.

Builds Data Culture

Vision Data Governance can change the way banks think about

and behave towards data. It establishes a datacentric culture

that defines roles and responsibilities, and it improves

accountability with respect to data.

Delivers world class Data Management capabilities

Vision Data Governance provides extended tools for enhanced

data management i.e. for data quality, metadata, and data architecture. It shares pre-built business glossary and data dictionaries, and also delineates the data ecosystem key to banking applicatins.

Implements Data Delivery capabilities

Vision Data Governance enhances data delivery by delivering the

data you need. It supports real-time data generation and converts data into information that can be used to

make strategic business decisions.

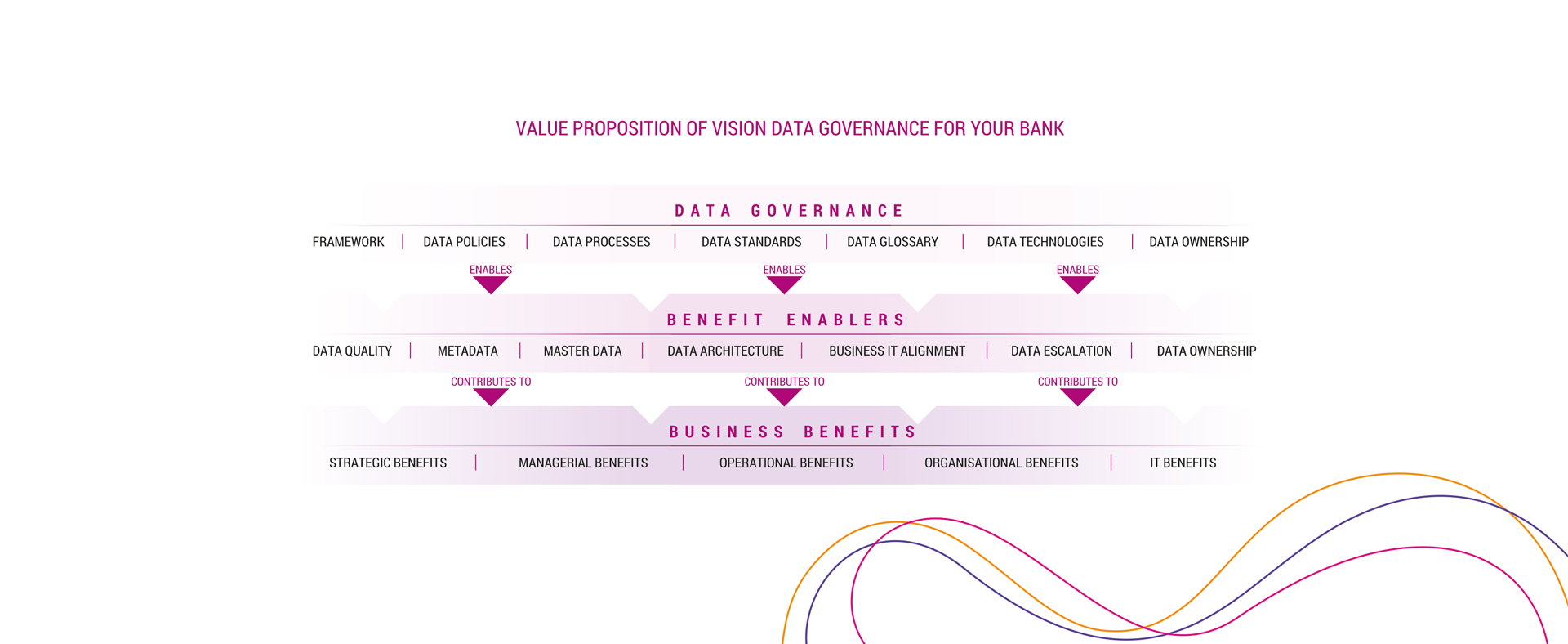

Why Vision Data Governance

Vision Data Governance brings the right data framework, data policies and data technologies to ensure your business runs with the highest quality data to deliver better business outcomes.

Deep banking domain expertise

The framework for Vision Data Governance has been designed by Bankers for Bankers.

Support when you need it most

One-on-one support with a dedicated team of Data Governance consultants and Data Governance specialists.

Profit from high data quality

Vision Data Governance ensures high data quality throughout the complete lifecycle of the data to strongly support business objectives.