29% of global banking customers

are willing to switch banks

Leverage Artificial Intelligence as a Service

(AIaaS) with best-in-class marketing automation

Optimize marketing costs with targeted and hyper-personalised

campaigns and communications

Vision AI brings industry standard CRISP-DM

methodology for AI implementation

delivering 70-75% accuracy

That means a greater probability of your customers choosing your bank's

products and services consistently

Harness the power of Sunoida'sVision Artificial Intelligence (AI)

Gain predictive capabilities through enhanced analytics to ensure your profitability stays on track

Vision AI is an outcomes-focused AI based application that identifies customers with churn risk and recommends targeted hyper-personalised engagement strategies. Its advanced algorithms also help manage NPAs more efficiently, get loan behaviour predictions and helps decipher the Customer Lifetime Value (CLV) of individual customers by assigning a future monetary value to a customer relationship. CLV is a strong indicator that predicts their future spend and likelihood to stay with your bank.

Vision AI helps banks analyse enormous amounts of information to gain new acumen with speed, precision and insights for improved decision-making.

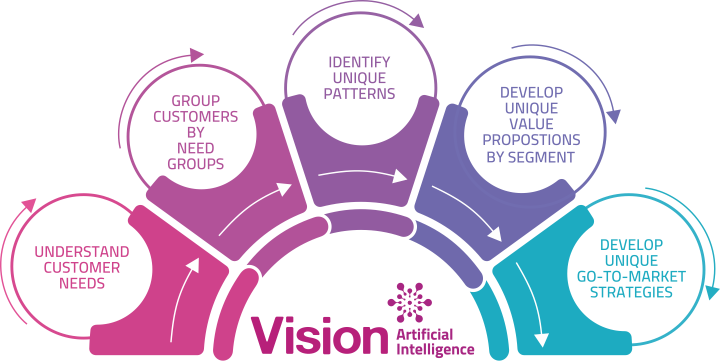

Achieve enhanced customer segmentation and hyper-personalisation with Vision AI

With the new digital wave, personalization has reached an all new level – that of omnichannel orchestrated personalized offers. AI led customer segmentation help today’s financial institutions understand customers much better and achieve comprehensive customer profiling with the help of data mining algorithms. Vision AI achieves this through its unique clustering algorithms that deliver classification and identification of customers segments through cluster analysis.

Vision AI helps characterize and discover customer segments on a real-time basis, helping banks identify cross-sell and up-sell opportunities at an individual customer level. This helps in creating and delivering highly accurate marketing communications, offers, and products to the right customer at the right time.

Put complexities to rest and manage NPAs more efficiently with Vision AI

As banks look to expand their credit portfolio and manage NPAs simultaneously, asset quality continues to be the biggest challenge. Early identification of rising NPAs and investigating suspicious transactions is paramount to banks staying healthy.

Vision AI brings together advanced machine learning methods to analyse unstructured granular data from transactions, client profiles and more sources to discover non-linear relationships among different attributes and entities.

Tracking non-linear relationships through Vision AI helps identify suspicious transactions that require more investigation, thereby creating greater opportunities for banks to manage their NPAs more efficiently.

Get advanced loan behaviour prediction with Vision AI

Predicting mortgage delinquency is a highly complex exercise due to large number of variables that affect the outcome of a loan. Vision AI uses a machine learning based non-linear, non-parametric approach to predict loan defaulters.

Vision AI includes algorithms that allow identification of the predictive power of specific variables, helping banks know the current status of their assets.

It also helps analyse transactions and demographic data to identify patterns that can indicate the likelihood of assets that may become non-performing. Delinquency prediction using this method can help lenders substantially reduce their lending and refinancing risks.

Predict Customer Lifetime Value (CLV) with Vision AI

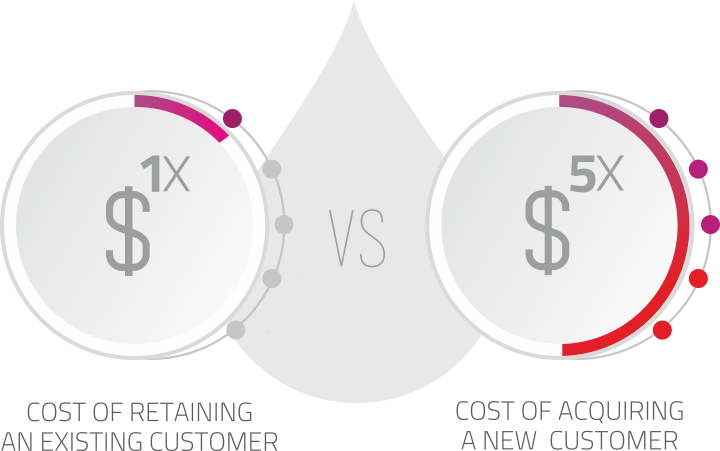

Customer Lifetime Value (CLV) is a predictive indicator of every individual customer’s contribution to the bank’s profitability. It prescribes the present value of future cash flow attributed to a customer, throughout the entire length of relationship with the bank. Lifetime value assigns a future monetary value to a customer relationship by predicting their future spend and likelihood to stay with the brand.

Vision AI data uses highly evolved data mining algorithms and analytical tools to discover every customer’s potential, behavioral patterns and characteristics, helping banks identify their true loyalty base.

CLV is a complex, powerful metric that gives banks a way to understand the financial impact of customer relationships over their forecast timelines, helping build focused strategies for quality customer acquisition.

Make smarter marketing decisions and retain customers on the go with Vision AI

Identify customer churn

Identify customers who are likely to close their accounts based on historical data, with sophisticated AI/ML algorithms that provide a holistic view of the customer.

Leverage AIaaS

Leverage Artificial-Intelligence-as-a-Service (AIaaS) with best-in-class

marketing automation that adopts a unique sliding window approach to

create meaningful customer interactions and opportunities.

Optimise marketing costs

Optimize marketing costs with targeted hyper-personalized campaigns

as against less-effective generic campaigns.

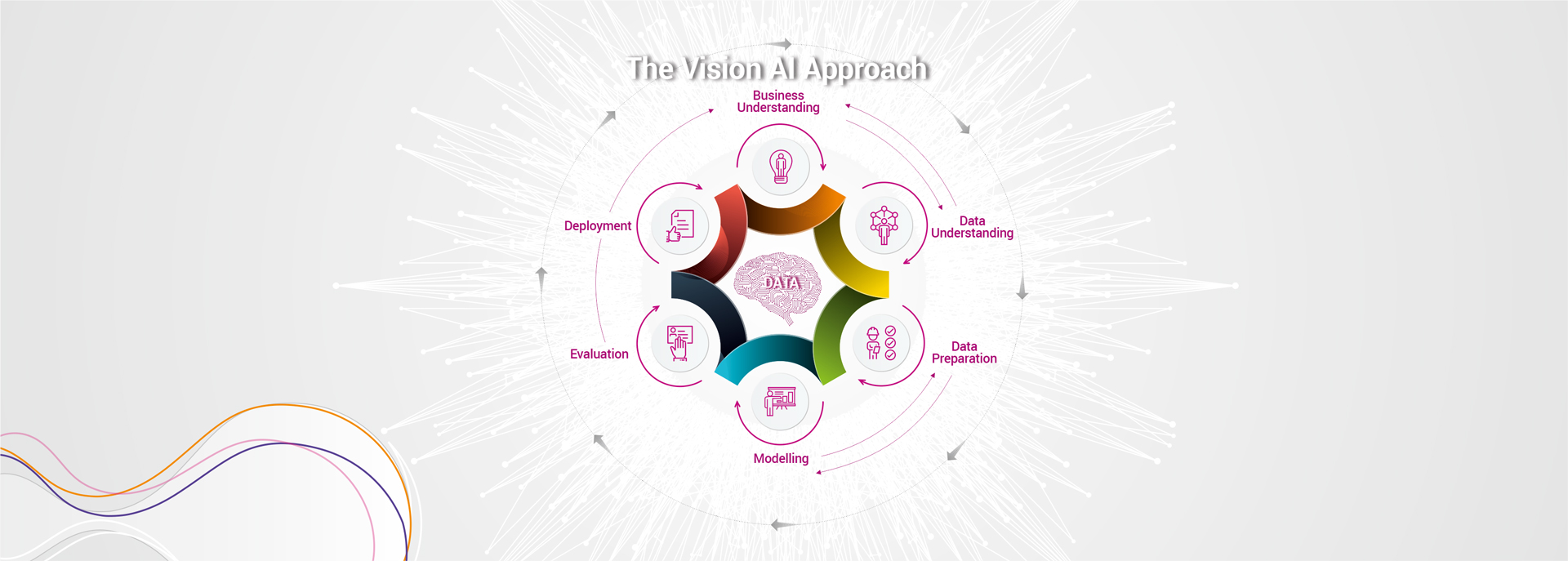

How Vision AI works

From simplistic data exploration to building complex analytical models, using advanced machine learning/AI algorithms, we help banks identify the right engagement strategies by providing customized and unique AI model for each customer analysing the inputs received.

Sunoida’s solutions leverage the industry standard CRISP-DM methodology for AI implementation, potentially delivering between 70-75% accuracy on recommendations. Our 6-step approach ensures a reliable and successful roll out of AIaaS for banks looking to leverage the power of AI. To remain competitive and win customer loyalty, early signs from AI and Machine Learning are powerful and uncannily accurate. It’s time for you to find out.

Vision Banking Bi Modules: Everything you need.

Vision AI: 6 steps to a reliable roll out of

AIaaS: Artificial Intelligence as a Service

1 . Business Understanding

Stakeholders along with data scientists determine the business objectives, business success criteria, requirements, assumptions, constraints, costs and benefits.

2 . Data Understanding

Vision AI collects the available data, exploratory data analysis is performed and the data quality is verified comprehensively.

3 . Data Preparation

From the collected input, we methodically integrate the data from various sources.

4 . Modelling

Specific parameters are set using various modelling tools, after which we begin building the right AI model.

5 . Evaluation

The data mining results are evaluated and after an exhaustive review process, a list of possible actions is prepared.

6 . Deployment

The final report is prepared and the Vision AI platform is delivered as per the client’s requirements.

The best performing banks choose Vision Banking BI

Vision Artificial Intelligence Platform

Implementation of simple web analytics to understand your customers is no longer par for the course. Get the power of machine learning and AI based analytics to predict future scenarios and stay in true control – no matter what.

Deep banking domain expertise

Sunoida's Artificial Intelligence Platform has been designed by Bankers for Bankers.

Support when you need it most

One-on-one support with a dedicated team of analysts and data scientists.

Speed & Accuracy

Powerful AI and Machine Learning engine that is uncannily accurate.