What’s your single source of truth?

Seize the $25B Data driven value creation opportunity in the next round of digital disruption

The new normal: Data will continue to drive

all business decisions from here on

Step up to the simple truth with intelligent data analytics that will help

your bank make profitable decisions

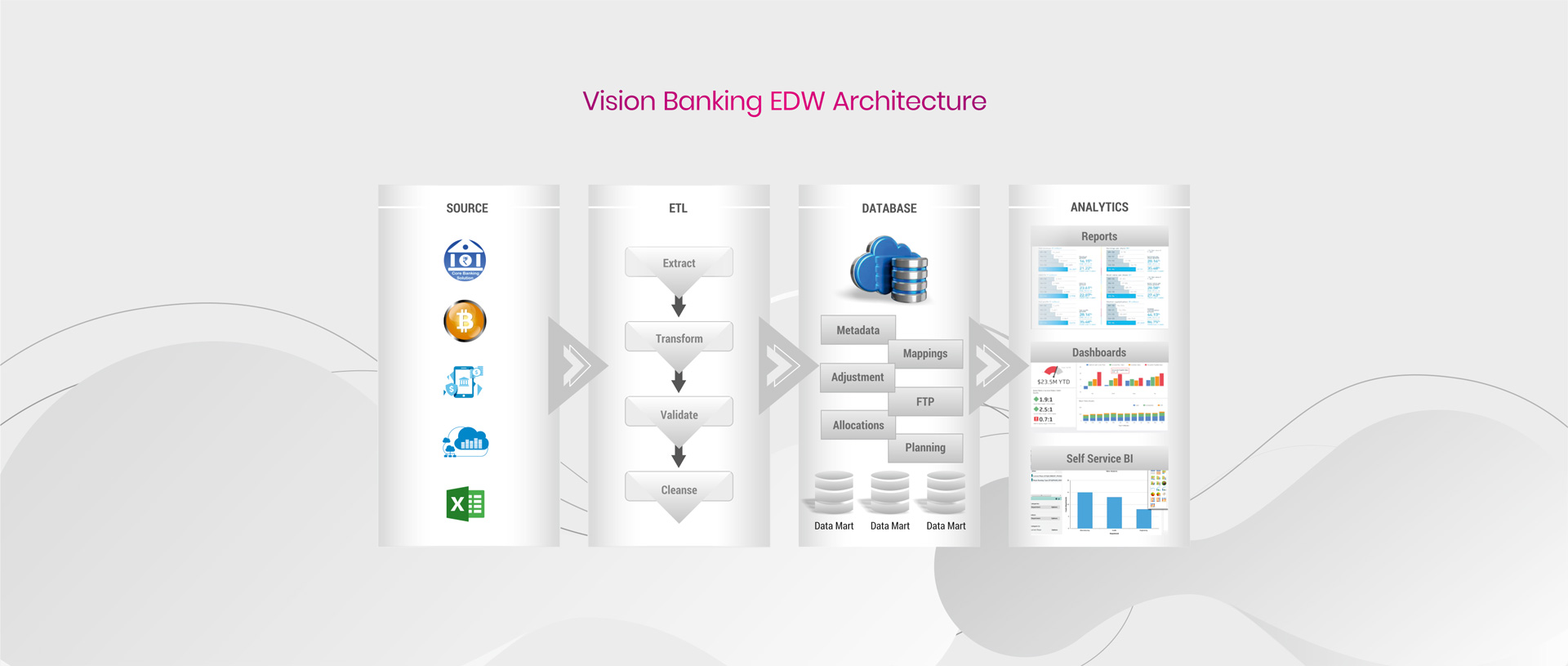

Far from being just a single repository, Vision EDW

creates opportunities you didn’t think existed

Unlock potential, make decisions faster and seize new opportunities like never before

Vision Banking EDW: Your key to unlock latent opportunities in real time

Banks possess ginormous amounts of data, and data has come to rule every major business decision. Leading banks are harnessing it to make real-time critical business decisions that will impact the bank’s bottom line, meet regulatory deadlines and address customer needs. But not every set of data originates at the same level nor should be consumed at the same level. Vision Banking EDW from Sunoida goes beyond the principles of a single information source addressing data more holistically.

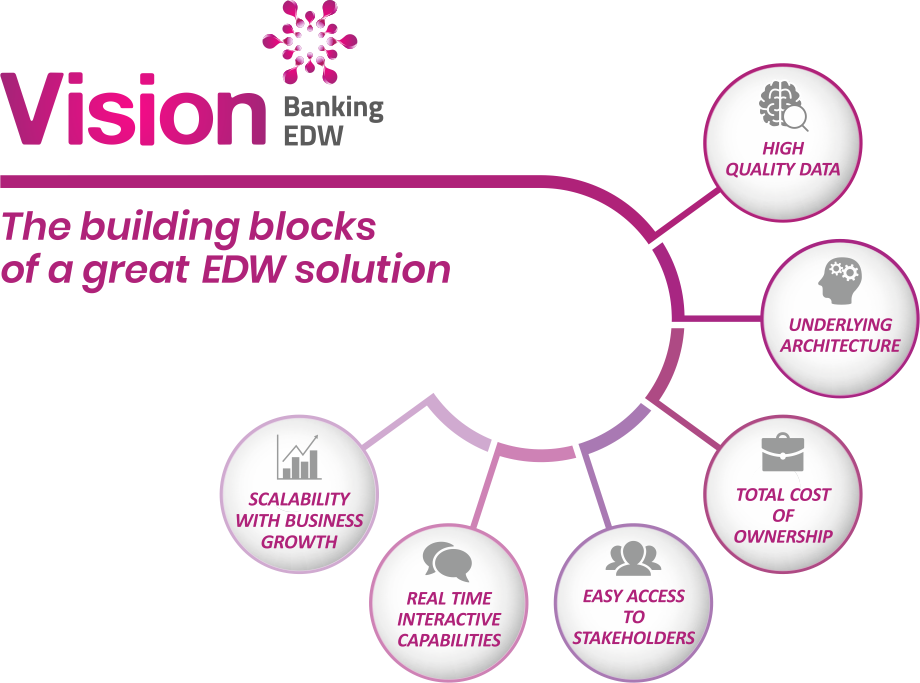

The difference between good and great data is in the building blocks of your data warehouse

Vision Banking EDW: A high-performance and high-integrity data warehousing solution

Implement Vision Banking EDW ground up or get more out of your existing data warehouse.

Best-of-breed technologies, best practices and thought leadership from our Centers of Excellence

Conquer business complexities and drive smarter and faster decision making.

Accurate real-time actionable insights delivered at the right time

Unlock new revenue streams and monetization opportunities.

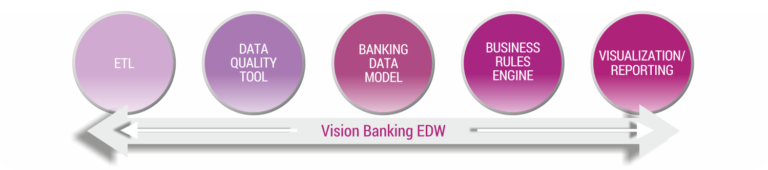

Key components of Vision Banking EDW

Vision Banking EDW makes it possible to for banks to make smarter and faster decisions

Sunoida’s Vision Banking EDW adopts a three-pronged solution framework that leverages best-of-breed technologies, best practices and thought leadership from our CoEs and best-in-class services delivered by bankers to conquer any business complexities.

Corrective Maintenance

Fix problems to enable your bank’s existing data warehouse to perform to its maximum functional capability.

Preventive Maintenance

Monitor events, jobs and interfaces for issues that could adversely impact system performance and correct at root cause.

Optimization Maintenance

Monitor existing data warehouse, fine tune and report on system performance continuously to reduce business process cycle.

Vision Banking DWH facilitates data-driven value creation simply easily

Establish the right reporting structures

Design & propose MIS reporting structures with best industry practices.

Get a 360 view of your customers

Identify the characteristics of your most and least profitable customers. Create models to identify behavioral pattern triggers of customers.

Set rules and parameters

Define Funds Transfer Pricing rules & parameters, Setup Cost Allocations definitions & parameters

Analyze product performance

Analyze penetration of products by geography, channel, segments etc.

Optimize data warehouse performance

Optimize existing data warehouse and fine-tuning performance

Identify monetization opportunities in real-time

Identify opportunities that are most profitable for you and most

relevant to your customers

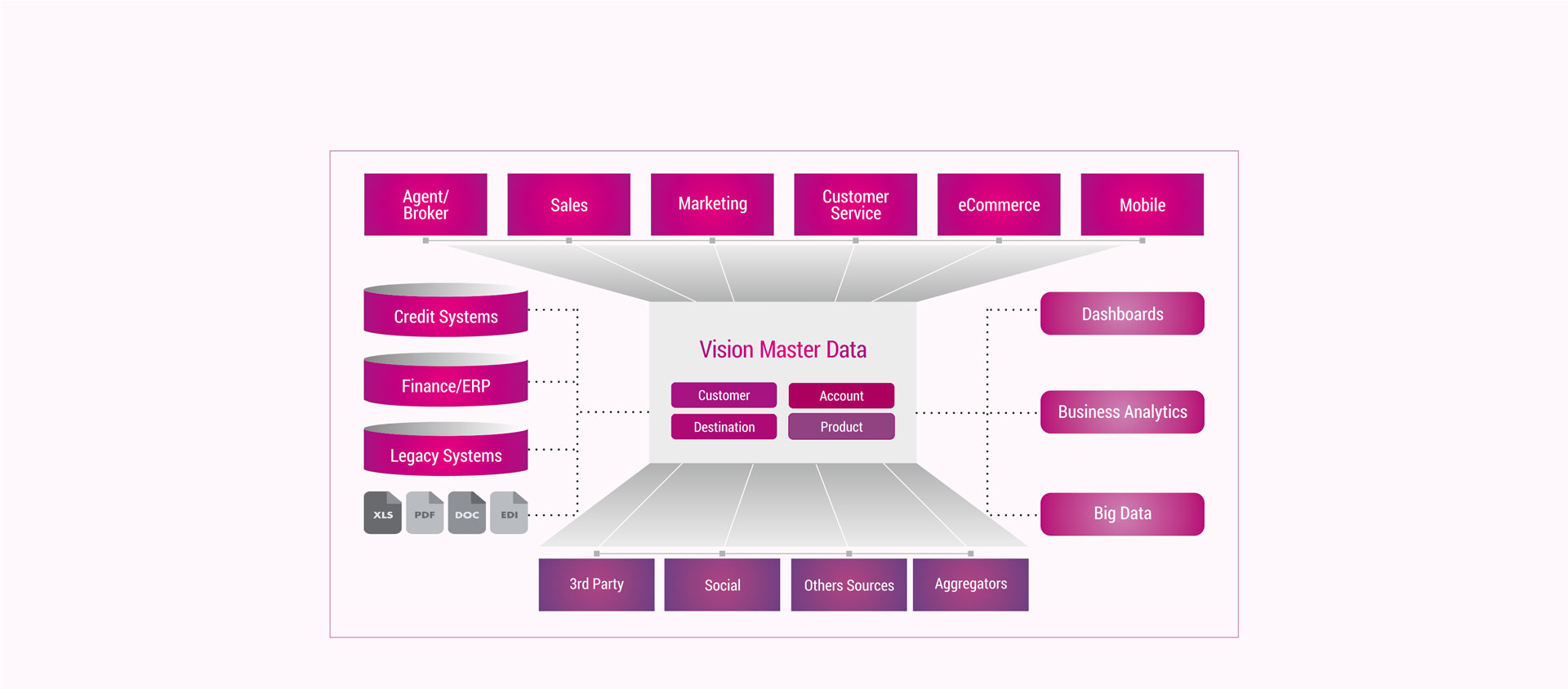

Master your data with Vision Banking EDW

Vision Banking EDW: Key Data Marts

Many more can be added as required or as requested by the customer.

Branch Analytics

• Asset Liability Management

• Transaction Profitability Analysis

Relationship Managers

• Business Growth & Profitability Analysis

• Performance Measurement

Product Performance

• Product Profitability Vs Cost of Delivery

• Product Cross Sell Opportunities

• Product Fees & Tax Analysis

Channel Analytics

• Channel Optimization (Usage & Outage)

• Channel Profitability

Customer 360

• Customer Profitability

• Customer Lifetime Value Analysis

Credit Data Mart

• Credit Risk Exposure Analysis

• Delinquency & Non Performing Loans Analysis

Consult with Sunoida on Business Intelligence

While banks have invested huge amounts of time and money into Business Intelligence, only a handful have been able to get the most out of their data. Many banks still work on unreliable intelligence or compromised functionality.

At Sunoida, we specialize in the art of creating information out of vast amounts of raw data. Our team of bankers and IT professionals possess the skills and expertise in information strategy, data warehousing, data mining and information analytics. We help banks transform data and achieve higher levels of performance by providing insights that can help identify new revenue-generating opportunities and improve operational efficiencies and visibility across the organization.

Profiting from a single source of truth: See how this bank did it

See how this leading African bank achieved

27% YoY profit growth with 34.8% efficiency

with a single source of truth.

Why Vision Banking EDW

Vision Banking EDW from Sunoida continues to help some of the top performing banks across geographies realize the true potential of their data. From feature sets designed by ex-bankers with decades of banking experience to cutting-edge analytics, see what else makes Vision Banking EDW the easy choice.

Quick ROI

End-to-end implementation in 4 months led by a senior banker.

Banking Data Model

Ready-made Banking Metadata Layer addressing all complex scenarios and needs.

Data Quality

In-built DQ module that validates and cleanses data from all source systems .

Cost Allocation & FTP Engine

Profitability Analysis at Account, Customer, Branch, RM, Products & Segment level.

Regulatory Reporting

Hassle free automation of all your regulatory reports.

Future Proof Products

A highly configurable system to support future business changes without customization.