The bottom line for every bank

is to prevent income leakage

Turn revenue leaks across your customer

engagement lifecycle into profits

All banks are grappling with hidden revenue

leakages, Vision Revenue Assurance will turn

your leakages into profits

If your bank is struggling with uncontrolled data that doesn’t make

sense, Vision Revenue Assurance might give you the answers

Gaining control over your revenue leakages starts

with gaining control over your data

Vision Revenue Assurance monitors every chargeable activity as it happens

Your lever for sustainable improvements in revenue, profits & cashflows

In this digital economy, Banks are delivering many products and services to their customers through an increasing number of channels. More channels and systems mean more leakage of income on a daily basis. The bank’s inability to realize revenue lost due to various reasons such as incorrect pricing, operational inefficiencies, missing transactions, unpriced transactions, uncollected revenues, etc amounts to Revenue Leakage. Revenue Leakage could happen at any or all stages of the customer engagement cycle.

Vision Revenue Assurance Solution is a scalable and highly adaptive solution that enables banks to identify many points of income leakage across the customer engagement cycle and ensure that these points of leakage are identified and fixed in an automated manner, instantly boosting the banks profit, improving operational efficiencies and enhancing customer experiences.

Key challenges faced by banks in identifying and preventing income leakage

- Increasing number of channels for same product/service

- Non-uniform application of rules across all channels

- Complex interest computation structure

- Operational and human errors

- Charges structure varies at customer level

- Unauthorized discounts / Discount Management

- Limitations in CBS and Product Processors

- No automated mechanism to identify income leakage

Retaining an existing customer costs 5X lesser than acquiring a new customer.

Advantages all around for greater profits

Advantages all around for greater profits

Configurable Engine

Easy to use and flexible configuration engine to integrate to setup income details on transactions

Income Leakage

Identify, fix and predict income leakages across channels and products

Variance Reports

Get a 360 visibility into your customer transactions and insights to fix income variances

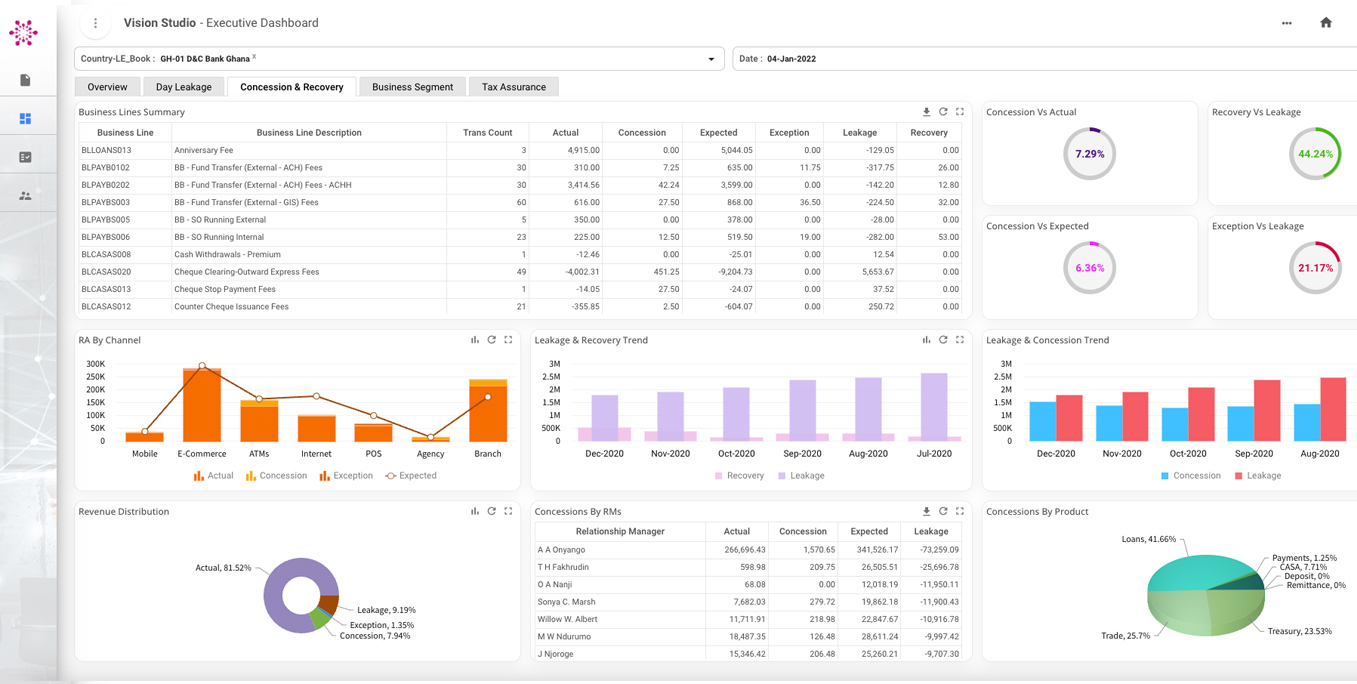

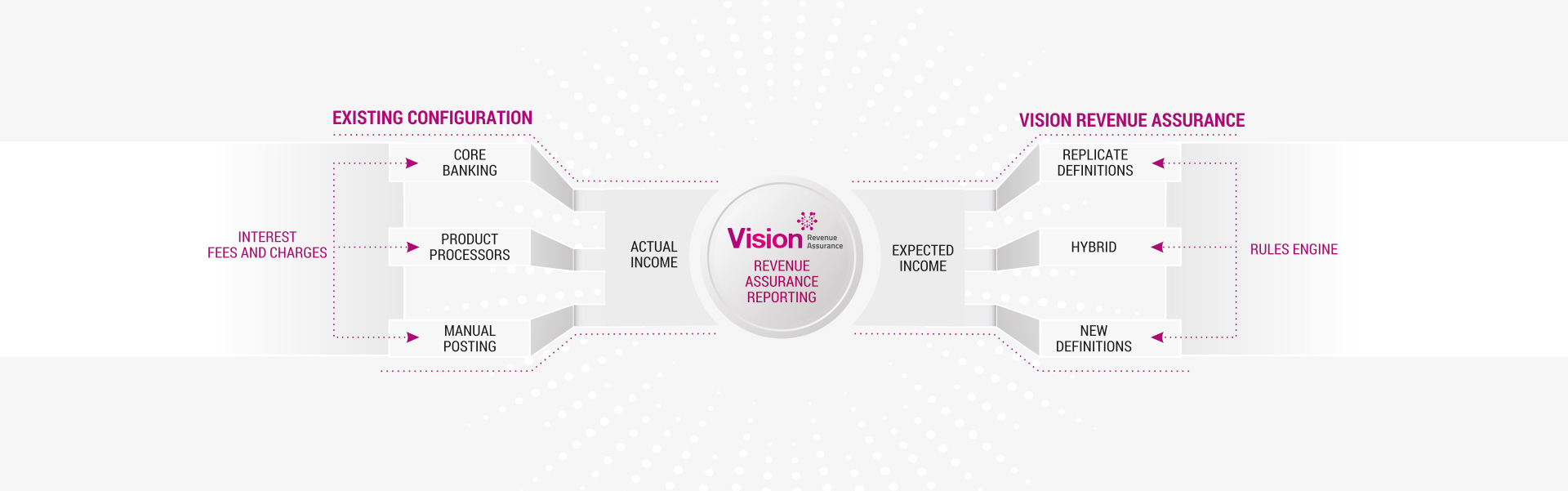

How Vision Revenue Assurance works

Sunoida’s Vision Revenue Assurance is an easily configurable engine with an in-built reporting suite that will provide full visibility on every transaction with your customers. It is a parallel processing engine from your CBS that calculates the expected income at an account level on a daily basis and compares it with the actual income in your CBS, giving you analytics on the lost income.

Vision Revenue Assurance integrates with all the product processors and other relevant systems at the bank (cards system, collection platform, ATM, payment gateway, RTGS, internet banking, Mobile solutions, etc.) in a seamless manner.

With greater visibility and predictability of possible income leakages, Vision Revenue Assurance gives you the advantage to operate fearlessly with insights on income variances, so you can fix them on the go. Learn more today.

Vision Revenue Assurance Solution is a scalable and highly adaptive solution that enables banks to identify many points of income leakage across the customer engagement cycle and ensure that these points of leakage are addressed in a systematic and automated manner which instantly boosts the banks profit, increases operational efficiencies and enhances customer experience.

Vision Banking Bi Modules: Everything you need.

Vision Revenue Assurance: Feature packed to deliver profits

Ready ETL with most common CBS applications

Drill down daily variance report up to transaction level

Handle complexities and increase customer experience

Short lead time to Go-Live and quick ROI

Full automated and scalable mechanism

Gain operational efficiency and profitability

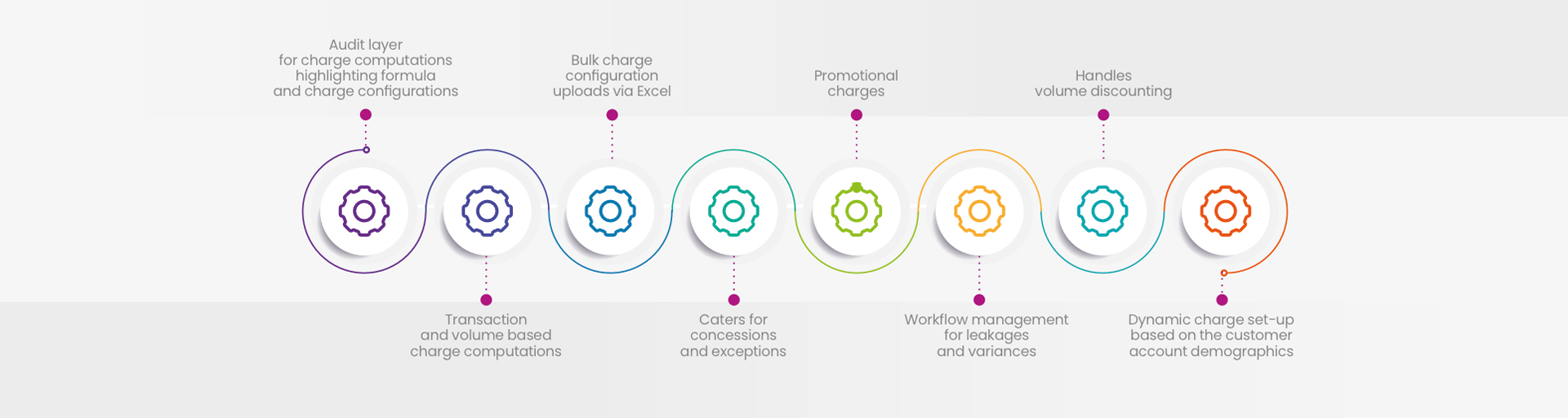

Charge Engine

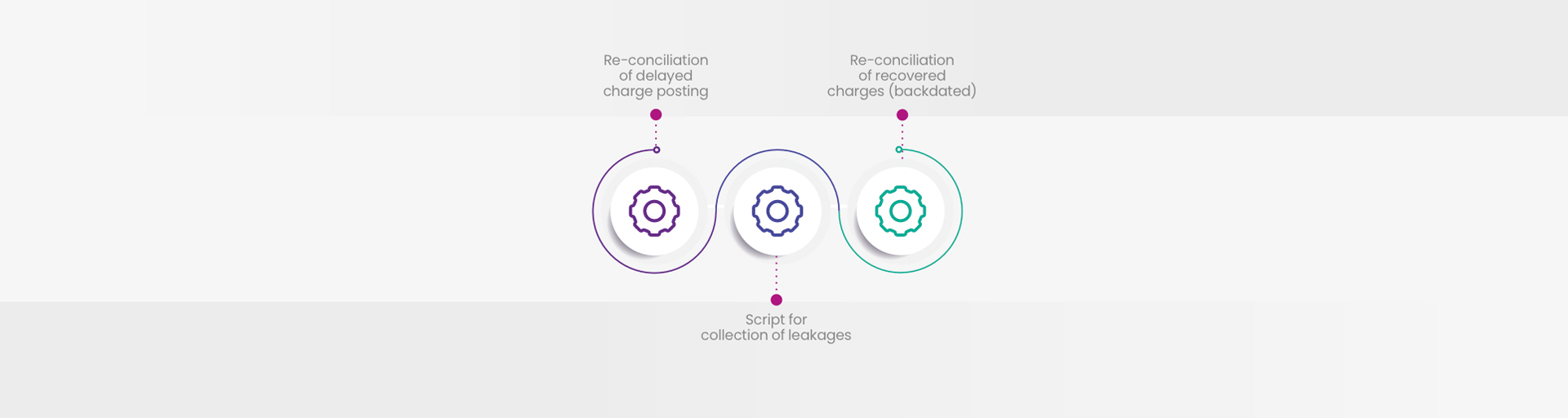

Recovery Engine

Vision Revenue Assurance provides variance analytics

through dashboards and detailed analysis through many

drill-down reports that provide information in easy to view formats.

Turning customer engagement into real profits: See how this bank did it

See how a leading African Bank with global

footprint across 22 countries leveraged the power

of Vision Banking BI to plug income leakage, save

time and resources and find real growth.

A leading African Bank with US$15B in assets and

750 branches uses Vision Revenue Assurance to

gain massively through its 3.5M+ daily

transactions touching 7.5M+ customers

Why Vision Revenue Assurance

Plug income leakage, gain full visibility and greater operational control over every single customer transaction, seamlessly and effortlessly.

Fully automated and scalable mechanism

Meet growing demands and requirements of your future products and banking channels easily

Factor in varied complexities

Covers interest computation, customer-level specific charge structures and even operational errors

Gain operational efficiency and profitability

Realize an ROI that is many times over your investment on the platform in just weeks

'Gained significant value’

Since the successful deployment of Sunoida’s Vision Revenue Assurance solution few months back, Equity Bank Kenya has gained significant value from the solution and improved the customer experience which our Bank is always striving to do. We are delighted with the Vision solution and our partnership with Sunoida.

Equity Bank (K) Limited

'Highly adaptive solution’

Vision Revenue Assurance is a scalable and highly adaptive solution that enables our bank to identify income leakage across the customer engagement cycle and ensure that these points of leakage are addressed in a systematic and automated manner that enhances the bank’s profitability.

NCBA Bank, Kenya

'Highly advanced solution’

CalBank has implemented the Vision Revenue Assurance solution, which effectively examines transactions related to products and services. This advanced system automatically detects instances of revenue loss at a transactional level using its comprehensive revenue assurance analytics, which consider various dimensions. The outcome has been a favorable influence on the bank’s overall revenue and profitability.

CalBank Ghana

‘Partners since 2015’

Sunoida is one of the few solution providers who always under promise and over deliver. Their team has gone out of their way many times to meet our ever changing business needs. We have thoroughly enjoyed our Data Analytics & Revenue Assurance partnership with them since 2015.

Prime Bank, Kenya