Meet existing and emerging regulatory demands and

compliance needs with confidence and ease

Get assured accuracy in reporting with Vision RegTech

Vision checks all the boxes to meet your

regulatory reporting needs every single time

The fastest growing banks trust Vision RegTech to achieve guaranteed accuracy

Vision delivers accurate submission-ready reports

perfectly tailored to meet all regulatory expectations

Get customized and automated reports

that checks all the boxes across the board

Achieve flawless reporting in today’s rapidly evolving and highly demanding regulatory landscape

The fast-changing financial environment has placed a spotlight on the process of regulatory returns. Existing manual processes are not only time intensive but also pose various risks to the Bank. With new technology around regulatory reporting and the ever-increasing demands from the Central Bank in every country, it’s imperative that banks embark on automation to reduce errors, avoid the risk of non-compliance and also strict reporting timelines from regulatory bodies. Sustainable automation that can meet evolving requirements is the need of the hour.

Here’s why Sunoida’s highly proven Vision RegTech solution is a best-fit for today’s banks. Designed and developed by bankers for bankers by banking technology specialists, Vision RegTech automatically retrieves the relevant data, automates and creates review ready reports, aids easy validation and makes them submission ready – all on the go. Read on and see why the best performing banks choose Sunoida’s Vision RegTech.

Today’s digital landscape means added new demands and challenges for banks to continuously cope with both existing and emerging regulatory demands while trying to meet their overall growth goals consistently. Sounds familiar?

Supervisory bodies today rely heavily on regulatory reporting by banks to inform them of potential risks that may be forming in regulated entities, which can have broader implications for the financial system. With evolving landscapes in the digital age, Central banks and supervisory boards have to constantly improve on the regulatory reporting requirements to ensure a robust financial system.

Get automated end-to-end reporting with Vision RegTech

Made for banks who set sights on high growth

Integrate and automate

Metadata management

Retrieve Data

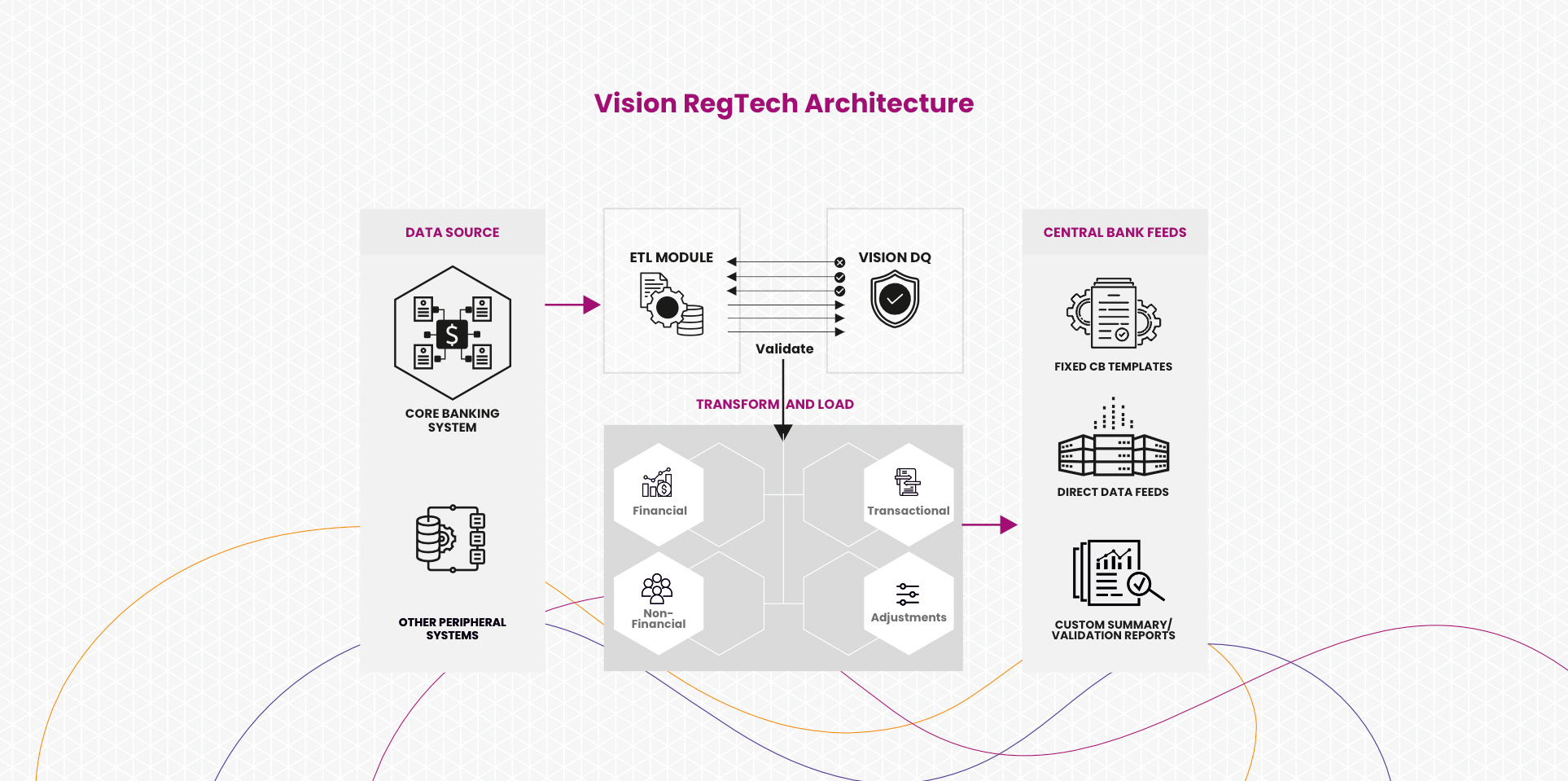

Vision RegTech retrieves data from various data sources while provisioning for validations and data quality checks at multiple defined levels.

Review Reports

Vision RegTech gives the ability to review and confirm that all data is correctly presented before every submission.

Submit Reports

Once all of the data and reports are validated and complete, they can be automatically setup for final submission into the Regulator’s portal.

All-round benefits for all time compliance

High Data Quality

Single Source of Truth

Seamless Regulatory Reporting

Automating entire Regulatory Reporting will not only save a lot of time but will also improves accuracy and compliance.

Faster Turnaround Time

Create a Repository for Audit

Daily Interactive Reporting

Future Solutions

The Sunoida Difference

Why Sunoida Vision RegTech

Vision RegTech is designed for the fastest growing banks that are looking to power up their regulatory reporting process with true automation.

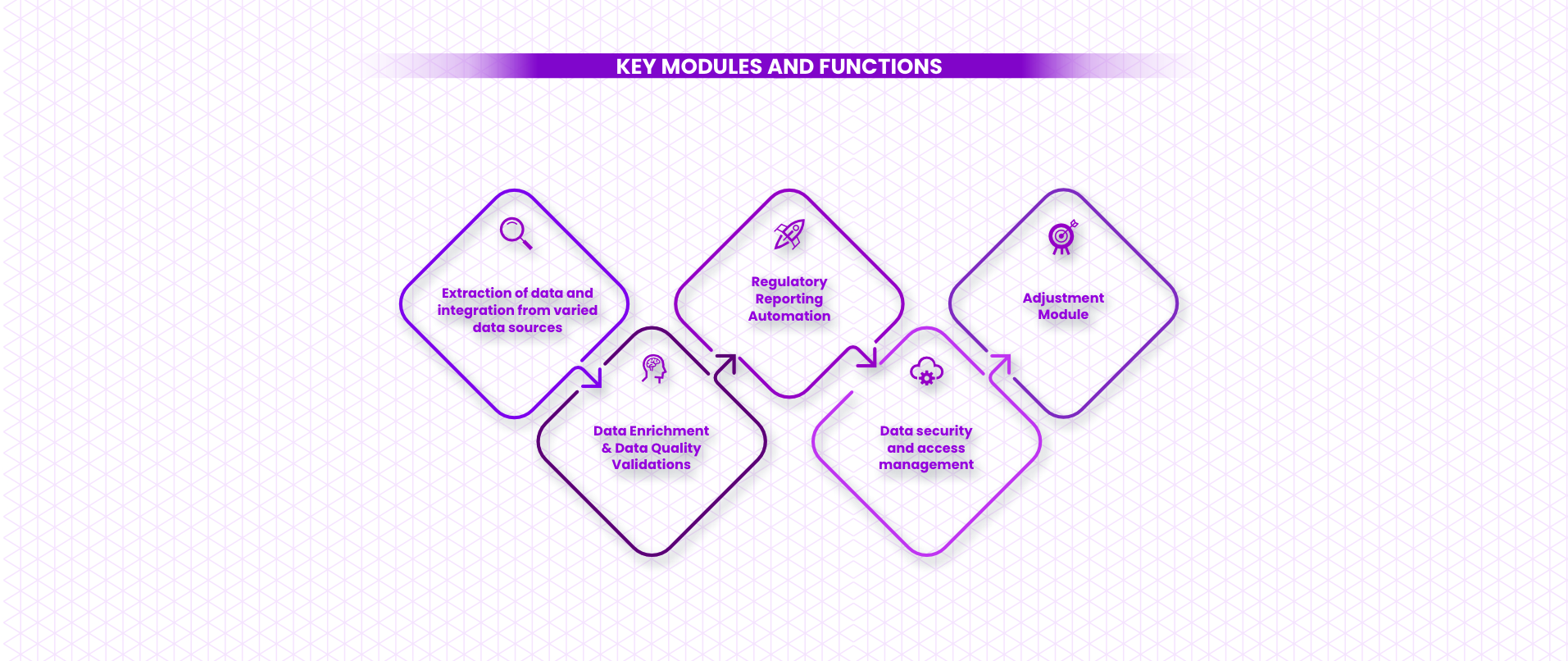

Plug and play modular solution

Vision RegTech easily integrates and automates ETL with any source system including existing core banking applications.

Meet compliance needs automatically

Easily meet compliance and regulatory requirements with Vision's in-built and highly robust data validation automated tools.

Submission ready reports on time!

Gain unmatched new levels of efficiency in meeting regulatory deadlines and submissions with timely and accurate reports.